доллар с учетом инфляции по годам

Как доллар стал мировой валютой?

Рассказ об этом был бы увлекательным, но очень длинным, поэтому назовем только несколько самых важных вех.

В 1944 году многие страны мира подписали Бреттон-Вудское соглашение. В Бреттон-Вудской системе произошел отказ от золотого стандарта как способа пересчета валют в международной торговле. Операции между разными странами стали совершаться в долларах США, но сам доллар еще сохранял привязку к золоту. Оборот золотых монет фактически исчез и на мировом рынке, и внутри стран. Золото перестало быть деньгами, но стало товаром.

В течение 1970-х годов оформилась и заработала Ямайская система. Был отменен золотой стандарт, страны перешли к плавающему курсу валют. Появилось понятие резервных валют, первой из которых был доллар.

К началу 21 века больше половины международных валютных операций шло в долларах. Доллары США составляли примерно 2/3 валютных резервов всех государств мира.

Как доллар появился в кошельках иностранных граждан?

Во второй половине 20 века многие государства прошли период гиперинфляции. Самым доступным способом сбережения стала покупка долларов, ведь золотых монет в обороте уже не было, а другие надежные валюты (немецкая марка, швейцарский франк) встречались реже.

Особенный интерес к долларам почувствовали жители бывшего СССР, потому что рубли, что советские, что новые российские и белорусские, годились только для быстрых расчетов, дешевели каждый месяц и для сбережений на годы не подходили.

Со временем появилась привычка сберегать в основном в долларах и назначать цену крупных покупок исключительно в долларах. Доллар стал всеобщим эквивалентом стоимости в сделках с недвижимостью, автомобилями и другими крупными покупками.

А сколько стоит сам доллар?

Этим вопросом задаются не часто, хотя на него есть официальный ответ.

Доллар США тоже дешевеет со временем. Эту инфляцию подсчитывают и публикуют статистические органы США и другие структуры (в т.ч. международные).

Инфляция доллара происходила всегда. Для примера

Если бы в 1920 году кто-то написал в завещании, что его далекому потомку следует отдать 1000 долларов в 2018 году, то оказалось бы, что:

В ценах это еще нагляднее:

Конечно, цены менялись непропорционально, сравнивать кожаные ботинки начала прошлого века, которые носили десятилетиями, и современные кроссовки, некорректно. Но кое-что можно оценить по значимости для покупателя:

Но перейдем из далеких годов в памятные многим 90-е.

Перевести это в цену товаров сложнее, они менялись разнонаправленно. Вот данные по США за последние 20 лет:

Точно оценить изменение расходов по рисунку нельзя, но понять общий рост цен можно. Это и есть инфляция доллара.

Что это значит для Беларуси?

Неизбежный вывод: рост цены в долларах пропорционален падению цены доллара относительно товаров и услуг

Причина – естественное выравнивание цен из-за движения товаров между странами. Цены импорта, особенно потребительского, одинаковы для всех стран. За импортом понемногу растут цены отечественных товаров услуг, а рост зарплат в долларах компенсирует и ускоряет этот процесс.

Может доллар подорожать, а цены в долларах упасть?

Могут упасть цены на многие продукты в период низкого спроса, могут дешеветь определенные категории товаров, например – техника благодаря новым технологиям. Но общего устойчивого падения не было никогда. И в Беларуси это может оказаться заметнее, чем в других странах.

Почему так? Потому что стоимость жизни в Беларуси приближается к этому показателю в других странах. По данным Всемирного банка стоимость жизни в США выше, чем в Беларуси в среднем на 119,43%, в Германии жить дороже на 101,85%, в Польше – на 18,93%, в Литве – на 35,87%. Потенциал для роста есть.

Что делать с долларами?

В коротком периоде лучше ориентироваться по ситуации, доллар может и подешеветь, и подорожать. Но в перспективе доллары лучше куда-то вкладывать. Долгосрочные валютные депозиты, особенно с капитализацией процентов, компенсируют инфляцию доллара, те самые 2-2,5% в год или 100% за 20 лет. Другие варианты инвестиций обычно выгодней, но и риск потерять вложения выше.

U.S. Inflation Rate Calculator from 1665 through 2021

Use the form on this page to perform your own inflation calculation for any year.

This means that today’s prices are 33.32 times higher than average prices since 1860, according to the Bureau of Labor Statistics consumer price index. A dollar today only buys 3.00% of what it could buy back then.

| Cumulative price change | 3,232.40% |

| Average inflation rate | 2.20% |

| Converted amount ($1 base) | $33.32 |

| Price difference ($1 base) | $32.32 |

| CPI in 1860 | 8.300 |

| CPI in 2021 | 276.589 |

| Inflation in 1860 | 0.00% |

| Inflation in 2021 | 6.22% |

| $1 in 1860 | $33.32 in 2021 |

According to the Bureau of Labor Statistics, each of these USD amounts below is equal in terms of what it could buy at the time:

| Year | Dollar Value | Inflation Rate |

|---|---|---|

| 1860 | $1.00 | — |

| 1861 | $1.06 | 6.02% |

| 1862 | $1.22 | 14.77% |

| 1863 | $1.52 | 24.75% |

| 1864 | $1.89 | 24.60% |

| 1865 | $1.96 | 3.82% |

| 1866 | $1.92 | -2.45% |

| 1867 | $1.78 | -6.92% |

| 1868 | $1.71 | -4.05% |

| 1869 | $1.64 | -4.23% |

| 1870 | $1.58 | -3.68% |

| 1871 | $1.47 | -6.87% |

| 1872 | $1.47 | 0.00% |

| 1873 | $1.45 | -1.64% |

| 1874 | $1.37 | -5.00% |

| 1875 | $1.33 | -3.51% |

| 1876 | $1.29 | -2.73% |

| 1877 | $1.27 | -1.87% |

| 1878 | $1.20 | -4.76% |

| 1879 | $1.20 | 0.00% |

| 1880 | $1.23 | 2.00% |

| 1881 | $1.23 | 0.00% |

| 1882 | $1.23 | 0.00% |

| 1883 | $1.22 | -0.98% |

| 1884 | $1.18 | -2.97% |

| 1885 | $1.17 | -1.02% |

| 1886 | $1.13 | -3.09% |

| 1887 | $1.14 | 1.06% |

| 1888 | $1.14 | 0.00% |

| 1889 | $1.11 | -3.16% |

| 1890 | $1.10 | -1.09% |

| 1891 | $1.10 | 0.00% |

| 1892 | $1.10 | 0.00% |

| 1893 | $1.08 | -1.10% |

| 1894 | $1.04 | -4.44% |

| 1895 | $1.01 | -2.33% |

| 1896 | $1.01 | 0.00% |

| 1897 | $1.00 | -1.19% |

| 1898 | $1.00 | 0.00% |

| 1899 | $1.00 | 0.00% |

| 1900 | $1.01 | 1.20% |

| 1901 | $1.02 | 1.19% |

| 1902 | $1.04 | 1.18% |

| 1903 | $1.06 | 2.33% |

| 1904 | $1.07 | 1.14% |

| 1905 | $1.06 | -1.12% |

| 1906 | $1.08 | 2.27% |

| 1907 | $1.13 | 4.44% |

| 1908 | $1.11 | -2.13% |

| 1909 | $1.10 | -1.09% |

| 1910 | $1.14 | 4.40% |

| 1911 | $1.14 | 0.00% |

| 1912 | $1.17 | 2.11% |

| 1913 | $1.19 | 2.06% |

| 1914 | $1.20 | 1.01% |

| 1915 | $1.22 | 1.00% |

| 1916 | $1.31 | 7.92% |

| 1917 | $1.54 | 17.43% |

| 1918 | $1.82 | 17.97% |

| 1919 | $2.08 | 14.57% |

| 1920 | $2.41 | 15.61% |

| 1921 | $2.16 | -10.50% |

| 1922 | $2.02 | -6.15% |

| 1923 | $2.06 | 1.79% |

| 1924 | $2.06 | 0.00% |

| 1925 | $2.11 | 2.34% |

| 1926 | $2.13 | 1.14% |

| 1927 | $2.10 | -1.69% |

| 1928 | $2.06 | -1.72% |

| 1929 | $2.06 | 0.00% |

| 1930 | $2.01 | -2.34% |

| 1931 | $1.83 | -8.98% |

| 1932 | $1.65 | -9.87% |

| 1933 | $1.57 | -5.11% |

| 1934 | $1.61 | 3.08% |

| 1935 | $1.65 | 2.24% |

| 1936 | $1.67 | 1.46% |

| 1937 | $1.73 | 3.60% |

| 1938 | $1.70 | -2.08% |

| 1939 | $1.67 | -1.42% |

| 1940 | $1.69 | 0.72% |

| 1941 | $1.77 | 5.00% |

| 1942 | $1.96 | 10.88% |

| 1943 | $2.08 | 6.13% |

| 1944 | $2.12 | 1.73% |

| 1945 | $2.17 | 2.27% |

| 1946 | $2.35 | 8.33% |

| 1947 | $2.69 | 14.36% |

| 1948 | $2.90 | 8.07% |

| 1949 | $2.87 | -1.24% |

| 1950 | $2.90 | 1.26% |

| 1951 | $3.13 | 7.88% |

| 1952 | $3.19 | 1.92% |

| 1953 | $3.22 | 0.75% |

| 1954 | $3.24 | 0.75% |

| 1955 | $3.23 | -0.37% |

| 1956 | $3.28 | 1.49% |

| 1957 | $3.39 | 3.31% |

| 1958 | $3.48 | 2.85% |

| 1959 | $3.51 | 0.69% |

| 1960 | $3.57 | 1.72% |

| 1961 | $3.60 | 1.01% |

| 1962 | $3.64 | 1.00% |

| 1963 | $3.69 | 1.32% |

| 1964 | $3.73 | 1.31% |

| 1965 | $3.80 | 1.61% |

| 1966 | $3.90 | 2.86% |

| 1967 | $4.02 | 3.09% |

| 1968 | $4.19 | 4.19% |

| 1969 | $4.42 | 5.46% |

| 1970 | $4.67 | 5.72% |

| 1971 | $4.88 | 4.38% |

| 1972 | $5.04 | 3.21% |

| 1973 | $5.35 | 6.22% |

| 1974 | $5.94 | 11.04% |

| 1975 | $6.48 | 9.13% |

| 1976 | $6.86 | 5.76% |

| 1977 | $7.30 | 6.50% |

| 1978 | $7.86 | 7.59% |

| 1979 | $8.75 | 11.35% |

| 1980 | $9.93 | 13.50% |

| 1981 | $10.95 | 10.32% |

| 1982 | $11.63 | 6.16% |

| 1983 | $12.00 | 3.21% |

| 1984 | $12.52 | 4.32% |

| 1985 | $12.96 | 3.56% |

| 1986 | $13.20 | 1.86% |

| 1987 | $13.69 | 3.65% |

| 1988 | $14.25 | 4.14% |

| 1989 | $14.94 | 4.82% |

| 1990 | $15.75 | 5.40% |

| 1991 | $16.41 | 4.21% |

| 1992 | $16.90 | 3.01% |

| 1993 | $17.41 | 2.99% |

| 1994 | $17.86 | 2.56% |

| 1995 | $18.36 | 2.83% |

| 1996 | $18.90 | 2.95% |

| 1997 | $19.34 | 2.29% |

| 1998 | $19.64 | 1.56% |

| 1999 | $20.07 | 2.21% |

| 2000 | $20.75 | 3.36% |

| 2001 | $21.34 | 2.85% |

| 2002 | $21.67 | 1.58% |

| 2003 | $22.17 | 2.28% |

| 2004 | $22.76 | 2.66% |

| 2005 | $23.53 | 3.39% |

| 2006 | $24.29 | 3.23% |

| 2007 | $24.98 | 2.85% |

| 2008 | $25.94 | 3.84% |

| 2009 | $25.85 | -0.36% |

| 2010 | $26.27 | 1.64% |

| 2011 | $27.10 | 3.16% |

| 2012 | $27.66 | 2.07% |

| 2013 | $28.07 | 1.46% |

| 2014 | $28.52 | 1.62% |

| 2015 | $28.56 | 0.12% |

| 2016 | $28.92 | 1.26% |

| 2017 | $29.53 | 2.13% |

| 2018 | $30.27 | 2.49% |

| 2019 | $30.80 | 1.76% |

| 2020 | $31.18 | 1.23% |

| 2021 | $33.32 | 6.87%* |

This conversion table shows various other 1860 amounts in today’s dollars, based on the 3,232.40% change in prices:

| Initial value | Equivalent value |

|---|---|

| $1 dollar in 1860 | $33.32 dollars today |

| $5 dollars in 1860 | $166.62 dollars today |

| $10 dollars in 1860 | $333.24 dollars today |

| $50 dollars in 1860 | $1,666.20 dollars today |

| $100 dollars in 1860 | $3,332.40 dollars today |

| $500 dollars in 1860 | $16,661.99 dollars today |

| $1,000 dollars in 1860 | $33,323.98 dollars today |

| $5,000 dollars in 1860 | $166,619.88 dollars today |

| $10,000 dollars in 1860 | $333,239.76 dollars today |

| $50,000 dollars in 1860 | $1,666,198.80 dollars today |

| $100,000 dollars in 1860 | $3,332,397.59 dollars today |

| $500,000 dollars in 1860 | $16,661,987.95 dollars today |

| $1,000,000 dollars in 1860 | $33,323,975.90 dollars today |

Inflation by Country

Inflation can also vary widely by country. For comparison, in the UK £1.00 in 1860 would be equivalent to £127.70 in 2021, an absolute change of £126.70 and a cumulative change of 12,669.85%.

Inflation by Spending Category

CPI is the weighted combination of many categories of spending that are tracked by the government. Breaking down these categories helps explain the main drivers behind price changes. This chart shows the average rate of inflation for select CPI categories between 1860 and 2021.

Compare these values to the overall average of 2.20% per year:

| Category | Avg Inflation (%) | Total Inflation (%) | $1 in 1860 → 2021 |

|---|---|---|---|

| Food and beverages | 3.89 | 46,664.16 | 467.64 |

| Housing | 4.17 | 71,575.26 | 716.75 |

| Apparel | 1.96 | 2,165.44 | 22.65 |

| Transportation | 3.28 | 17,913.67 | 180.14 |

| Medical care | 4.69 | 159,610.10 | 1,597.10 |

| Recreation | 1.14 | 521.58 | 6.22 |

| Education and communication | 1.84 | 1,770.07 | 18.70 |

| Other goods and services | 4.94 | 236,750.69 | 2,368.51 |

The graph below compares inflation in categories of goods over time. Click on a category such as «Food» to toggle it on or off:

For all these visualizations, it’s important to note that not all categories may have been tracked since 1860. This table and charts use the earliest available data for each category.

Inflation rates of specific categories

Inflation-adjusted measures

Our calculations use the following inflation rate formula to calculate the change in value between 1860 and today:

Then plug in historical CPI values. The U.S. CPI was 8.3 in the year 1860 and 276.589 in 2021:

To get the total inflation rate for the 161 years between 1860 and 2021, we use the following formula:

Plugging in the values to this equation, we get:

News headlines from 1860

Politics and news often influence economic performance. Here’s what was happening at the time:

Data Source & Citation

Raw data for these calculations comes from the Bureau of Labor Statistics ‘ Consumer Price Index (CPI), established in 1913. Inflation data from 1665 to 1912 is sourced from a historical study conducted by political science professor Robert Sahr at Oregon State University.

You may use the following MLA citation for this page: “$1 in 1860 → 2021 | Inflation Calculator.” Official Inflation Data, Alioth Finance, 10 Nov. 2021, https://www.officialdata.org/1860-dollars-in-2017?amount=1.

Special thanks to QuickChart for their chart image API, which is used for chart downloads.

in2013dollars.com is a reference website maintained by the Official Data Foundation.

About the author

Ian Webster is an engineer and data expert based in San Mateo, California. He has worked for Google, NASA, and consulted for governments around the world on data pipelines and data analysis. Disappointed by the lack of clear resources on the impacts of inflation on economic indicators, Ian believes this website serves as a valuable public tool. Ian earned his degree in Computer Science from Dartmouth College.

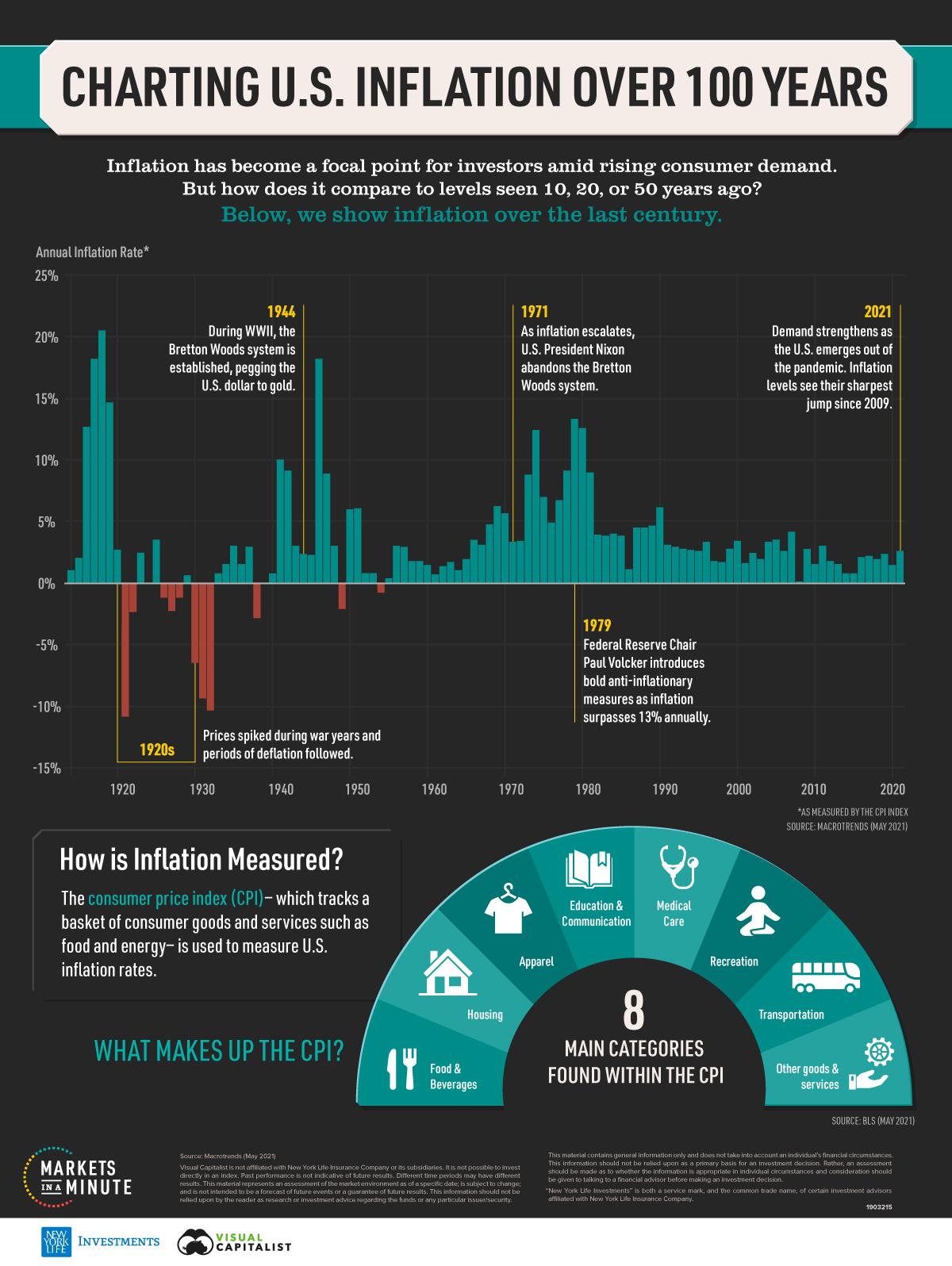

Визуализация истории инфляции в США за 100 лет

Индекс потребительских цен (ИПЦ), индекс, используемый в качестве показателя инфляции потребительских цен, предлагает некоторые ответы. В 2020 году инфляция упала до 1,4%, самого низкого уровня с 2015 года. Для сравнения, по состоянию на июнь 2021 года инфляция составляет около 5,0%.

К 1971 году способность покрывать золотом предложение долларов США в обращении вызывала все большее беспокойство. К этому моменту излишек денежной массы создавался за счет военных расходов, иностранной помощи и других факторов. В ответ президент Ричард Никсон отказался от Бреттон-Вудского соглашения в 1971 году в пользу плавающего курса, что известно как «шок Никсона». В режиме плавающего обменного курса курсы колеблются в зависимости от спроса и предложения по отношению к другим валютам. Несколько лет спустя нефтяные шоки 1973 и 1974 годов привели к тому, что инфляция превысила 12%. К 1979 году инфляция превысила 13%.

В 1979 году председатель Федеральной резервной системы Пол Волкер был приведен к присяге и внес серьезные изменения для борьбы с инфляцией, которые отличались от предыдущих режимов. Вместо того, чтобы управлять инфляцией с помощью процентных ставок, что Федеральная резервная система делала ранее, инфляция будет управляться путем контроля денежной массы. Если бы денежная масса была ограничена, это привело бы к увеличению процентных ставок. В то время как процентные ставки подскочили до 20% в 1980 году, к 1983 году инфляция упала ниже 4%, поскольку экономика оправилась от рецессии 1982 года, а цены на нефть росли более умеренно. В течение последних четырех десятилетий уровни инфляции оставались относительно стабильными с тех пор, как были введены в действие меры эпохи Волкера.

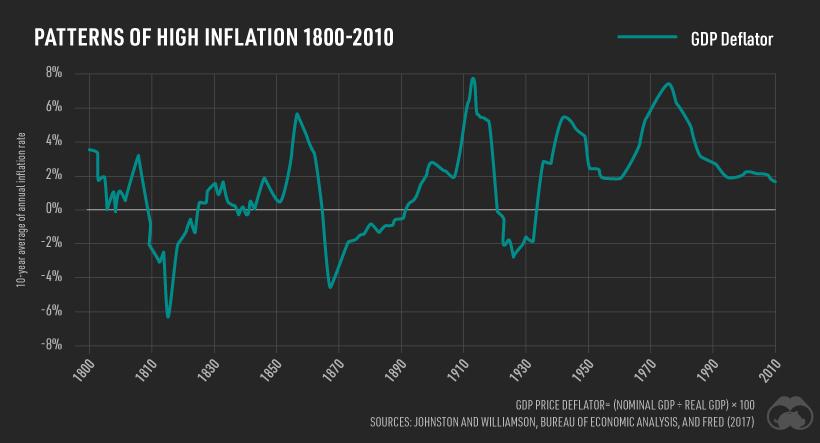

На протяжении всей истории США. были периоды высокой инфляции. Как показано на приведенной ниже диаграмме, между 1800 и 2010 годами возникло по крайней мере четыре отчетливых периода высокой инфляции. Показанное измерение дефлятора ВВП учитывает изменение цен на все товары и услуги в экономике, в отличие от индекса ИПЦ, который является фиксированной корзиной товаров. Он измеряется как Дефлятор цен ВВП = (Номинальный ВВП ÷ Реальный ВВП) × 100.

По мере восстановления экономики США потребительский спрос усиливается. Между тем, узкие места в поставках, от полупроводниковых чипов до пиломатериалов, создают нагрузку на автомобильную и технологическую промышленность. Хотя это указывает на рост инфляции, некоторые предполагают, что это может быть временным явлением, поскольку в 2020 году цены были низкими. В то же время Федеральная резервная система следует режиму «таргетирования средней инфляции», что означает, что если предыдущий дефицит инфляции произошел в предыдущем году, это позволит компенсировать его более высокими периодами инфляции. Поскольку последнее десятилетие характеризовалось низкой инфляцией и низкими процентными ставками, любой продолжительный период инфляции, вероятно, окажет заметное влияние на инвесторов и финансовые рынки.

ПыСы. С моей точки зрения то, что происходило в период Великой депрессии здесь не совсем верно описано, лучше почитать здесь и здесь.

И не забывайте подписываться на мой телеграм-канал и YouTube-канал

Inflation Calculator

Inflation Calculator with U.S. CPI Data

Calculates the equivalent value of the U.S. dollar in any year from 1914 to 2021. Calculations are based on the average annual CPI data in the U.S. from 1914 to 2020.

Forward Flat Rate Inflation Calculator

Calculates an inflation based on a certain average inflation rate after some years.

Backward Flat Rate Inflation Calculator

Calculates the equivalent purchasing power of an amount some years ago based on a certain average inflation rate.

Historical Inflation Rate (CPI) for the U.S.

In the United States, the Bureau of Labor Statistics publishes the Consumer Price Index (CPI) every month, which can be translated into the inflation rate. The following is the listing of the historical inflation rate for the United States (U.S. dollar) since it is available.

| Year | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Annual |

| 2020 | 2.49% | 2.33% | 1.54% | 0.33% | 0.12% | 0.65% | 0.99% | 1.31% | 1.37% | 1.18% | 1.17% | 1.36% | 1.24% |

| 2019 | 1.55% | 1.52% | 1.86% | 2.00% | 1.79% | 1.65% | 1.81% | 1.75% | 1.71% | 1.76% | 2.05% | 2.29% | 1.81% |

| 2018 | 2.07% | 2.21% | 2.36% | 2.46% | 2.80% | 2.87% | 2.95% | 2.70% | 2.28% | 2.52% | 2.18% | 1.91% | 2.44% |

| 2017 | 2.50% | 2.74% | 2.38% | 2.20% | 1.87% | 1.63% | 1.73% | 1.94% | 2.23% | 2.04% | 2.20% | 2.11% | 2.13% |

| 2016 | 1.37% | 1.02% | 0.85% | 1.13% | 1.02% | 1.01% | 0.84% | 1.06% | 1.46% | 1.64% | 1.69% | 2.07% | 1.26% |

| 2015 | -0.09% | -0.03% | -0.07% | -0.20% | -0.04% | 0.12% | 0.17% | 0.20% | -0.04% | 0.17% | 0.50% | 0.73% | 0.12% |

| 2014 | 1.58% | 1.13% | 1.51% | 1.95% | 2.13% | 2.07% | 1.99% | 1.70% | 1.66% | 1.66% | 1.32% | 0.76% | 1.62% |

| 2013 | 1.59% | 1.98% | 1.47% | 1.06% | 1.36% | 1.75% | 1.96% | 1.52% | 1.18% | 0.96% | 1.24% | 1.50% | 1.47% |

| 2012 | 2.93% | 2.87% | 2.65% | 2.30% | 1.70% | 1.66% | 1.41% | 1.69% | 1.99% | 2.16% | 1.76% | 1.74% | 2.07% |

| 2011 | 1.63% | 2.11% | 2.68% | 3.16% | 3.57% | 3.56% | 3.63% | 3.77% | 3.87% | 3.53% | 3.39% | 2.96% | 3.16% |

| 2010 | 2.63% | 2.14% | 2.31% | 2.24% | 2.02% | 1.05% | 1.24% | 1.15% | 1.14% | 1.17% | 1.14% | 1.50% | 1.64% |

| 2009 | 0.03% | 0.24% | -0.38% | -0.74% | -1.28% | -1.43% | -2.10% | -1.48% | -1.29% | -0.18% | 1.84% | 2.72% | -0.34% |

| 2008 | 4.28% | 4.03% | 3.98% | 3.94% | 4.18% | 5.02% | 5.60% | 5.37% | 4.94% | 3.66% | 1.07% | 0.09% | 3.85% |

| 2007 | 2.08% | 2.42% | 2.78% | 2.57% | 2.69% | 2.69% | 2.36% | 1.97% | 2.76% | 3.54% | 4.31% | 4.08% | 2.85% |

| 2006 | 3.99% | 3.60% | 3.36% | 3.55% | 4.17% | 4.32% | 4.15% | 3.82% | 2.06% | 1.31% | 1.97% | 2.54% | 3.24% |

| 2005 | 2.97% | 3.01% | 3.15% | 3.51% | 2.80% | 2.53% | 3.17% | 3.64% | 4.69% | 4.35% | 3.46% | 3.42% | 3.39% |

| 2004 | 1.93% | 1.69% | 1.74% | 2.29% | 3.05% | 3.27% | 2.99% | 2.65% | 2.54% | 3.19% | 3.52% | 3.26% | 2.68% |

| 2003 | 2.60% | 2.98% | 3.02% | 2.22% | 2.06% | 2.11% | 2.11% | 2.16% | 2.32% | 2.04% | 1.77% | 1.88% | 2.27% |

| 2002 | 1.14% | 1.14% | 1.48% | 1.64% | 1.18% | 1.07% | 1.46% | 1.80% | 1.51% | 2.03% | 2.20% | 2.38% | 1.59% |

| 2001 | 3.73% | 3.53% | 2.92% | 3.27% | 3.62% | 3.25% | 2.72% | 2.72% | 2.65% | 2.13% | 1.90% | 1.55% | 2.83% |

| 2000 | 2.74% | 3.22% | 3.76% | 3.07% | 3.19% | 3.73% | 3.66% | 3.41% | 3.45% | 3.45% | 3.45% | 3.39% | 3.38% |

| 1999 | 1.67% | 1.61% | 1.73% | 2.28% | 2.09% | 1.96% | 2.14% | 2.26% | 2.63% | 2.56% | 2.62% | 2.68% | 2.19% |

| 1998 | 1.57% | 1.44% | 1.37% | 1.44% | 1.69% | 1.68% | 1.68% | 1.62% | 1.49% | 1.49% | 1.55% | 1.61% | 1.55% |

| 1997 | 3.04% | 3.03% | 2.76% | 2.50% | 2.23% | 2.30% | 2.23% | 2.23% | 2.15% | 2.08% | 1.83% | 1.70% | 2.34% |

| 1996 | 2.73% | 2.65% | 2.84% | 2.90% | 2.89% | 2.75% | 2.95% | 2.88% | 3.00% | 2.99% | 3.26% | 3.32% | 2.93% |

| 1995 | 2.80% | 2.86% | 2.85% | 3.05% | 3.19% | 3.04% | 2.76% | 2.62% | 2.54% | 2.81% | 2.61% | 2.54% | 2.81% |

| 1994 | 2.52% | 2.52% | 2.51% | 2.36% | 2.29% | 2.49% | 2.77% | 2.90% | 2.96% | 2.61% | 2.67% | 2.67% | 2.61% |

| 1993 | 3.26% | 3.25% | 3.09% | 3.23% | 3.22% | 3.00% | 2.78% | 2.77% | 2.69% | 2.75% | 2.68% | 2.75% | 2.96% |

| 1992 | 2.60% | 2.82% | 3.19% | 3.18% | 3.02% | 3.09% | 3.16% | 3.15% | 2.99% | 3.20% | 3.05% | 2.90% | 3.03% |

| 1991 | 5.65% | 5.31% | 4.90% | 4.89% | 4.95% | 4.70% | 4.45% | 3.80% | 3.39% | 2.92% | 2.99% | 3.06% | 4.25% |

| 1990 | 5.20% | 5.26% | 5.23% | 4.71% | 4.36% | 4.67% | 4.82% | 5.62% | 6.16% | 6.29% | 6.27% | 6.11% | 5.39% |

| 1989 | 4.67% | 4.83% | 4.98% | 5.12% | 5.36% | 5.17% | 4.98% | 4.71% | 4.34% | 4.49% | 4.66% | 4.65% | 4.83% |

| 1988 | 4.05% | 3.94% | 3.93% | 3.90% | 3.89% | 3.96% | 4.13% | 4.02% | 4.17% | 4.25% | 4.25% | 4.42% | 4.08% |

| 1987 | 1.46% | 2.10% | 3.03% | 3.78% | 3.86% | 3.65% | 3.93% | 4.28% | 4.36% | 4.53% | 4.53% | 4.43% | 3.66% |

| 1986 | 3.89% | 3.11% | 2.26% | 1.59% | 1.49% | 1.77% | 1.58% | 1.57% | 1.75% | 1.47% | 1.28% | 1.10% | 1.91% |

| 1985 | 3.53% | 3.52% | 3.70% | 3.69% | 3.77% | 3.76% | 3.55% | 3.35% | 3.14% | 3.23% | 3.51% | 3.80% | 3.55% |

| 1984 | 4.19% | 4.60% | 4.80% | 4.56% | 4.23% | 4.22% | 4.20% | 4.29% | 4.27% | 4.26% | 4.05% | 3.95% | 4.30% |

| 1983 | 3.71% | 3.49% | 3.60% | 3.90% | 3.55% | 2.58% | 2.46% | 2.56% | 2.86% | 2.85% | 3.27% | 3.79% | 3.22% |

| 1982 | 8.39% | 7.62% | 6.78% | 6.51% | 6.68% | 7.06% | 6.44% | 5.85% | 5.04% | 5.14% | 4.59% | 3.83% | 6.16% |

| 1981 | 11.83% | 11.41% | 10.49% | 10.00% | 9.78% | 9.55% | 10.76% | 10.80% | 10.95% | 10.14% | 9.59% | 8.92% | 10.35% |

| 1980 | 13.91% | 14.18% | 14.76% | 14.73% | 14.41% | 14.38% | 13.13% | 12.87% | 12.60% | 12.77% | 12.65% | 12.52% | 13.58% |

| 1979 | 9.28% | 9.86% | 10.09% | 10.49% | 10.85% | 10.89% | 11.26% | 11.82% | 12.18% | 12.07% | 12.61% | 13.29% | 11.22% |

| 1978 | 6.84% | 6.43% | 6.55% | 6.50% | 6.97% | 7.41% | 7.70% | 7.84% | 8.31% | 8.93% | 8.89% | 9.02% | 7.62% |

| 1977 | 5.22% | 5.91% | 6.44% | 6.95% | 6.73% | 6.87% | 6.83% | 6.62% | 6.60% | 6.39% | 6.72% | 6.70% | 6.50% |

| 1976 | 6.72% | 6.29% | 6.07% | 6.05% | 6.20% | 5.97% | 5.35% | 5.71% | 5.49% | 5.46% | 4.88% | 4.86% | 5.75% |

| 1975 | 11.80% | 11.23% | 10.25% | 10.21% | 9.47% | 9.39% | 9.72% | 8.60% | 7.91% | 7.44% | 7.38% | 6.94% | 9.20% |

| 1974 | 9.39% | 10.02% | 10.39% | 10.09% | 10.71% | 10.86% | 11.51% | 10.86% | 11.95% | 12.06% | 12.20% | 12.34% | 11.03% |

| 1973 | 3.65% | 3.87% | 4.59% | 5.06% | 5.53% | 6.00% | 5.73% | 7.38% | 7.36% | 7.80% | 8.25% | 8.71% | 6.16% |

| 1972 | 3.27% | 3.51% | 3.50% | 3.49% | 3.23% | 2.71% | 2.95% | 2.94% | 3.19% | 3.42% | 3.67% | 3.41% | 3.27% |

| 1971 | 5.29% | 5.00% | 4.71% | 4.16% | 4.40% | 4.64% | 4.36% | 4.62% | 4.08% | 3.81% | 3.28% | 3.27% | 4.30% |

| 1970 | 6.18% | 6.15% | 5.82% | 6.06% | 6.04% | 6.01% | 5.98% | 5.41% | 5.66% | 5.63% | 5.60% | 5.57% | 5.84% |

| 1969 | 4.40% | 4.68% | 5.25% | 5.52% | 5.51% | 5.48% | 5.44% | 5.71% | 5.70% | 5.67% | 5.93% | 6.20% | 5.46% |

| 1968 | 3.65% | 3.95% | 3.94% | 3.93% | 3.92% | 4.20% | 4.49% | 4.48% | 4.46% | 4.75% | 4.73% | 4.72% | 4.27% |

| 1967 | 3.46% | 2.81% | 2.80% | 2.48% | 2.79% | 2.78% | 2.77% | 2.45% | 2.75% | 2.43% | 2.74% | 3.04% | 2.78% |

| 1966 | 1.92% | 2.56% | 2.56% | 2.87% | 2.87% | 2.53% | 2.85% | 3.48% | 3.48% | 3.79% | 3.79% | 3.46% | 3.01% |

| 1965 | 0.97% | 0.97% | 1.29% | 1.62% | 1.62% | 1.94% | 1.61% | 1.94% | 1.61% | 1.93% | 1.60% | 1.92% | 1.59% |

| 1964 | 1.64% | 1.64% | 1.31% | 1.31% | 1.31% | 1.31% | 1.30% | 0.98% | 1.30% | 0.97% | 1.30% | 0.97% | 1.28% |

| 1963 | 1.33% | 1.00% | 1.33% | 0.99% | 0.99% | 1.32% | 1.32% | 1.32% | 0.99% | 1.32% | 1.32% | 1.64% | 1.24% |

| 1962 | 0.67% | 1.01% | 1.01% | 1.34% | 1.34% | 1.34% | 1.00% | 1.34% | 1.33% | 1.33% | 1.33% | 1.33% | 1.20% |

| 1961 | 1.71% | 1.36% | 1.36% | 1.02% | 1.02% | 0.68% | 1.35% | 1.01% | 1.35% | 0.67% | 0.67% | 0.67% | 1.07% |

| 1960 | 1.03% | 1.73% | 1.73% | 1.72% | 1.72% | 1.72% | 1.37% | 1.37% | 1.02% | 1.36% | 1.36% | 1.36% | 1.46% |

| 1959 | 1.40% | 1.05% | 0.35% | 0.35% | 0.35% | 0.69% | 0.69% | 1.04% | 1.38% | 1.73% | 1.38% | 1.73% | 1.01% |

| 1958 | 3.62% | 3.25% | 3.60% | 3.58% | 3.21% | 2.85% | 2.47% | 2.12% | 2.12% | 2.12% | 2.11% | 1.76% | 2.73% |

| 1957 | 2.99% | 3.36% | 3.73% | 3.72% | 3.70% | 3.31% | 3.28% | 3.66% | 3.28% | 2.91% | 3.27% | 2.90% | 3.34% |

| 1956 | 0.37% | 0.37% | 0.37% | 0.75% | 1.12% | 1.87% | 2.24% | 1.87% | 1.86% | 2.23% | 2.23% | 2.99% | 1.52% |

| 1955 | -0.74% | -0.74% | -0.74% | -0.37% | -0.74% | -0.74% | -0.37% | -0.37% | 0.37% | 0.37% | 0.37% | 0.37% | -0.28% |

| 1954 | 1.13% | 1.51% | 1.13% | 0.75% | 0.75% | 0.37% | 0.37% | 0.00% | -0.37% | -0.74% | -0.37% | -0.74% | 0.32% |

| 1953 | 0.38% | 0.76% | 1.14% | 0.76% | 1.14% | 1.13% | 0.37% | 0.75% | 0.75% | 1.12% | 0.75% | 0.75% | 0.82% |

| 1952 | 4.33% | 2.33% | 1.94% | 2.33% | 1.93% | 2.32% | 3.09% | 3.09% | 2.30% | 1.91% | 1.14% | 0.75% | 2.29% |

| 1951 | 8.09% | 9.36% | 9.32% | 9.32% | 9.28% | 8.82% | 7.47% | 6.58% | 6.97% | 6.50% | 6.88% | 6.00% | 7.88% |

| 1950 | -2.08% | -1.26% | -0.84% | -1.26% | -0.42% | -0.42% | 1.69% | 2.10% | 2.09% | 3.80% | 3.78% | 5.93% | 1.09% |

| 1949 | 1.27% | 1.28% | 1.71% | 0.42% | -0.42% | -0.83% | -2.87% | -2.86% | -2.45% | -2.87% | -1.65% | -2.07% | -0.95% |

| 1948 | 10.23% | 9.30% | 6.85% | 8.68% | 9.13% | 9.55% | 9.91% | 8.89% | 6.52% | 6.09% | 4.76% | 2.99% | 7.74% |

| 1947 | 18.13% | 18.78% | 19.67% | 19.02% | 18.38% | 17.65% | 12.12% | 11.39% | 12.75% | 10.58% | 8.45% | 8.84% | 14.65% |

| 1946 | 2.25% | 1.69% | 2.81% | 3.37% | 3.35% | 3.31% | 9.39% | 11.60% | 12.71% | 14.92% | 17.68% | 18.13% | 8.43% |

| 1945 | 2.30% | 2.30% | 2.30% | 1.71% | 2.29% | 2.84% | 2.26% | 2.26% | 2.26% | 2.26% | 2.26% | 2.25% | 2.27% |

| 1944 | 2.96% | 2.96% | 1.16% | 0.57% | 0.00% | 0.57% | 1.72% | 2.31% | 1.72% | 1.72% | 1.72% | 2.30% | 1.64% |

| 1943 | 7.64% | 6.96% | 7.50% | 8.07% | 7.36% | 7.36% | 6.10% | 4.85% | 5.45% | 4.19% | 3.57% | 2.96% | 6.00% |

| 1942 | 11.35% | 12.06% | 12.68% | 12.59% | 13.19% | 10.88% | 11.56% | 10.74% | 9.27% | 9.15% | 9.09% | 9.03% | 10.97% |

| 1941 | 1.44% | 0.71% | 1.43% | 2.14% | 2.86% | 4.26% | 5.00% | 6.43% | 7.86% | 9.29% | 10.00% | 9.93% | 5.11% |

| 1940 | -0.71% | 0.72% | 0.72% | 1.45% | 1.45% | 2.17% | 1.45% | 1.45% | -0.71% | 0.00% | 0.00% | 0.71% | 0.73% |

| 1939 | -1.41% | -1.42% | -1.42% | -2.82% | -2.13% | -2.13% | -2.13% | -2.13% | 0.00% | 0.00% | 0.00% | 0.00% | -1.30% |

| 1938 | 0.71% | 0.00% | -0.70% | -0.70% | -2.08% | -2.08% | -2.76% | -2.76% | -3.42% | -4.11% | -3.45% | -2.78% | -2.01% |

| 1937 | 2.17% | 2.17% | 3.65% | 4.38% | 5.11% | 4.35% | 4.32% | 3.57% | 4.29% | 4.29% | 3.57% | 2.86% | 3.73% |

| 1936 | 1.47% | 0.73% | 0.00% | -0.72% | -0.72% | 0.73% | 1.46% | 2.19% | 2.19% | 2.19% | 1.45% | 1.45% | 1.04% |

| 1935 | 3.03% | 3.01% | 3.01% | 3.76% | 3.76% | 2.24% | 2.24% | 2.24% | 0.74% | 1.48% | 2.22% | 2.99% | 2.56% |

| 1934 | 2.33% | 4.72% | 5.56% | 5.56% | 5.56% | 5.51% | 2.29% | 1.52% | 3.03% | 2.27% | 2.27% | 1.52% | 3.51% |

| 1933 | -9.79% | -9.93% | -10.00% | -9.35% | -8.03% | -6.62% | -3.68% | -2.22% | -1.49% | -0.75% | 0.00% | 0.76% | -5.09% |

| 1932 | -10.06% | -10.19% | -10.26% | -10.32% | -10.46% | -9.93% | -9.93% | -10.60% | -10.67% | -10.74% | -10.20% | -10.27% | -10.30% |

| 1931 | -7.02% | -7.65% | -7.69% | -8.82% | -9.47% | -10.12% | -9.04% | -8.48% | -9.64% | -9.70% | -10.37% | -9.32% | -8.94% |

| 1930 | 0.00% | -0.58% | -0.59% | 0.59% | -0.59% | -1.75% | -4.05% | -4.62% | -4.05% | -4.62% | -5.20% | -6.40% | -2.66% |

| 1929 | -1.16% | 0.00% | -0.58% | -1.17% | -1.16% | 0.00% | 1.17% | 1.17% | 0.00% | 0.58% | 0.58% | 0.58% | 0.00% |

| 1928 | -1.14% | -1.72% | -1.16% | -1.16% | -1.15% | -2.84% | -1.16% | -0.58% | 0.00% | -1.15% | -0.58% | -1.16% | -1.15% |

| 1927 | -2.23% | -2.79% | -2.81% | -3.35% | -2.25% | -0.56% | -1.14% | -1.15% | -1.14% | -1.14% | -2.26% | -2.26% | -1.92% |

| 1926 | 3.47% | 4.07% | 2.89% | 4.07% | 2.89% | 1.14% | -1.13% | -1.69% | -1.13% | -0.56% | -1.67% | -1.12% | 0.94% |

| 1925 | 0.00% | 0.00% | 1.17% | 1.18% | 1.76% | 2.94% | 3.51% | 4.12% | 3.51% | 2.91% | 4.65% | 3.47% | 2.44% |

| 1924 | 2.98% | 2.38% | 1.79% | 0.59% | 0.59% | 0.00% | -0.58% | -0.58% | -0.58% | -0.58% | -0.58% | 0.00% | 0.45% |

| 1923 | -0.59% | -0.59% | 0.60% | 1.20% | 1.20% | 1.80% | 2.38% | 3.01% | 3.61% | 3.59% | 2.98% | 2.37% | 1.80% |

| 1922 | -11.05% | -8.15% | -8.74% | -7.73% | -5.65% | -5.11% | -5.08% | -6.21% | -5.14% | -4.57% | -3.45% | -2.31% | -6.10% |

| 1921 | -1.55% | -5.64% | -7.11% | -10.84% | -14.08% | -15.79% | -14.90% | -12.81% | -12.50% | -12.06% | -12.12% | -10.82% | -10.85% |

| 1920 | 16.97% | 20.37% | 20.12% | 21.56% | 21.89% | 23.67% | 19.54% | 14.69% | 12.36% | 9.94% | 7.03% | 2.65% | 15.90% |

| 1919 | 17.86% | 14.89% | 17.14% | 17.61% | 16.55% | 14.97% | 15.23% | 14.94% | 13.38% | 13.13% | 13.50% | 14.55% | 15.31% |

| 1918 | 19.66% | 17.50% | 16.67% | 12.70% | 13.28% | 13.08% | 17.97% | 18.46% | 18.05% | 18.52% | 20.74% | 20.44% | 17.26% |

| 1917 | 12.50% | 15.38% | 14.29% | 18.87% | 19.63% | 20.37% | 18.52% | 19.27% | 19.82% | 19.47% | 17.39% | 18.10% | 17.80% |

| 1916 | 2.97% | 4.00% | 6.06% | 6.00% | 5.94% | 6.93% | 6.93% | 7.92% | 9.90% | 10.78% | 11.65% | 12.62% | 7.64% |

| 1915 | 1.00% | 1.01% | 0.00% | 2.04% | 2.02% | 2.02% | 1.00% | -0.98% | -0.98% | 0.99% | 0.98% | 1.98% | 0.92% |

| 1914 | 2.04% | 1.02% | 1.02% | 0.00% | 2.06% | 1.02% | 1.01% | 3.03% | 2.00% | 1.00% | 0.99% | 1.00% | 1.35% |

The Inflation Calculator utilizes historical Consumer Price Index (CPI) data from the U.S. to convert the purchasing power of the U.S. dollar in different years. Simply enter an amount and the year it pertains to, followed by the year the inflation-adjusted amount pertains to.

There is also a Forward Flat Rate Inflation Calculator and Backward Flat Rate Inflation Calculator that can be used for theoretical scenarios to determine the inflation-adjusted amounts given an amount that is adjusted based on the number of years and inflation rate. Historically, inflation rates hover around 3% in the U.S. and many other developed countries, making it a safe assumption. However, feel free to adjust as needed.

What is Inflation?

Inflation is defined as a general increase in the prices of goods and services, and a fall in the purchasing power of money. Inflation can be artificial in that the authority, such as a central bank, king, or government, can control the supply of the money in circulation. Theoretically, if additional money is added into an economy, each unit of money in circulation will have less value. The inflation rate itself is generally conveyed as a percentage increase in prices over 12 months. Most developed nations try to sustain an inflation rate of around 2-3% through fiscal and monetary policy.

Hyperinflation is excessive inflation that rapidly erodes the real value of a currency. It usually occurs when there is a significant increase in money supply with little to no change in gross domestic product. Examples of hyperinflation can be seen in the countries of Ukraine in the early 1990s and Brazil from 1980 until 1994, where they endured long periods of hyperinflation and their currencies became essentially valueless. These hyperinflated economies caused terrible hardships for their people; Ukrainians and Brazilians had to cope by using stabilized foreign currencies and stocking up on finite resources that could retain value, such as gold. Another well-known example of hyperinflation was Germany in the 1920s when the government took stimulus measures such as printing money to pay for WWI. This happened at the same time as Germany was required to pay 132 billion marks in war reparations. This resulted in economic activity crumbling and shortages. With too much money and not enough goods and services, prices doubled every 3 days! The Papiermark, the German currency at the time, lost so much value that people were using it in place of firewood to heat their homes. The effects of hyperinflation were so severe that many people lived in poverty or fled the country.

While hyperinflation can cause immense hardship on an economy, it is considered healthy to have moderate levels of inflation from year to year. Because money will have less value in the future, there is an incentive for consumers to spend instead of stashing it away, and this incentive plays a key role in ensuring a healthy economy.

While inflation is not entirely good or bad depending on whether it is moderate or severe, deflation, the opposite of inflation, is seldom welcome in any economy. Deflation is defined as the general reduction of prices for goods and services. In such a scenario, consumers are not incentivized to spend since their money is forecasted to have more purchasing power in the future. This puts the brakes on and can even reverse what should be upward trending economies. The Great Depression came with something called the deflationary spiral. The theory behind a deflationary spiral is that as prices fall for goods and services, there is less profit. With less profit comes less spending. This, in turn, leads to even lower prices for goods and services, which forms a negative loop that can be immensely difficult to recover from.

Why Inflation Occurs?

Macroeconomic theories try to explain why inflation occurs and how best to regulate it. Keynesian economics, which served as the standard economic model in developed nations for most of the twentieth century and is still widely used today, says that when there are gaping imbalances between the supply and demand of goods and services, large-scale inflation or deflation can occur.

A group of economists (led by Milton Friedman) named the Monetarists believed that money supply is the main player in inflation, not markets. For instance, the Federal Reserve (the central bank in the U.S.) can print more money to increase supply or sell Treasury bills to decrease it. Public institutions play a major role in stabilizing their respective currencies through monetary policy. Their ideals are based on the Quantity Theory of Money, which states that changes in money supply will change the value of the currency. The Equation of Exchange best illustrates this:

In the Equation of Exchange, total spending (MV) is equal to total sales revenue (PY). V and Y are generally considered constant by economists; the number of transactions a currency goes through a year and the total economic output are certainly less volatile than the money supply or price level. By assuming V and Y to be relatively constant, what’s left are M and P, which leads to the Quantity Theory of Money, which states that the money supply is directly proportional to the value of the currency.

In reality, a mixture of both Keynesian and Monetarist policies is used. Although Keynesians and Monetarists have their differences, they do admit that there are necessities from the opposing side. For instance, Keynesians do not completely disregard the role that money supply has in economies, just as Monetarists do not completely disregard manipulating the demand for goods and services to fix inflation.

How is Inflation Calculated?

In the U.S., the Department of Labor is responsible for calculating inflation from year to year. Usually, a basket of goods and services on the market are put together and the costs associated with them are compared at various periods. These figures are then averaged and weighted using various formulas and the end result in the U.S. is a number called the Consumer Price Index (CPI).

As an example, to find the inflation from January 2016 to January 2017, first, look up the CPI for both months. Historical CPI data can be found on The Bureau of Labor Statistics website:

Jan. 2016: 236.916

Jan. 2017: 242.839

Calculate the difference:

Calculate the ratio of this difference to the former CPI:

| = 2.5% |

The inflation from January 2016 to January 2017 was 2.5%. When the CPI for the former period is greater than the latter, the result is deflation rather than inflation.

Problems with Measuring Inflation

While the example given above to calculate CPI might portray inflation as a simple process, in the real world, measuring the true inflation of currencies can prove to be quite difficult.

How to Beat Inflation?

Unfortunately, there is no perfect hedge against inflation. It is common for people to purchase real estate property, stock, funds, commodities, TIPS, art, antiques, and other assets to hedge against inflation. All these investment options have pros and cons. Investors usually own more than one type of these assets to manage risk. Commodities and TIPS are discussed more often because they are closely related to inflation. However, they are not necessarily the best investment hedge against inflation.

Investing in commodities, which include gold, silver, oil, copper, and many raw materials or agricultural products, is one of the popular ways through which a person can protect themselves from inflation because commodities are items that have intrinsic value. In addition, during times of high inflation, as money loses its value, demand for commodities can increase their value. For many centuries, gold was traditionally viewed as an effective resource with which a person could hedge against inflation because it is a finite resource with value that can be stored easily. While other precious metals can be used to hedge against inflation, gold is the most popular.